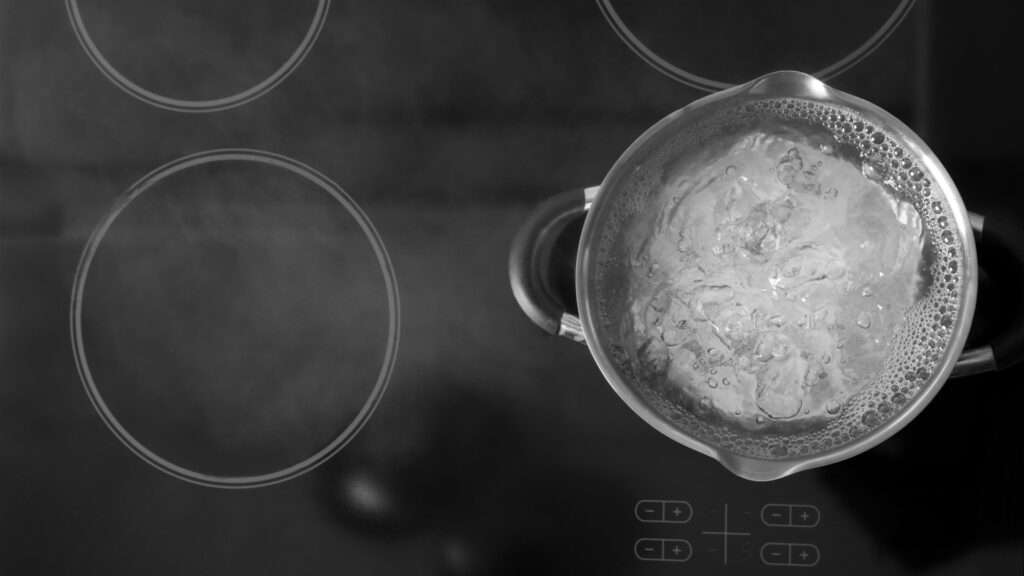

As we start to approach the great British summer perhaps boiling isn’t quite the correct analogy if we are comparing the heat in UK property market directly with the weathe?¦ maybe a slight sizzle?

Sadly, for those of us planning our summer, the weather isn’t quite at the same temperature as the UK property market, and if it was it’s likely that it would break through the mercury and leave a thermometer smashed to bits.

That’s because, despite the previous year and its economic happenings, property is way outperforming, and has outperformed, the rest of the UK economy by some distance.

Throughout 2020 and when restrictions were in place, many had expected that residential property in the UK, and buy to let, would have cooled alongside other sectors and industries, but that never happened and actually, the market outperformed even the previous year’s performance.

There could be a number of reasons for that, including tax breaks that the government brought in to incentivise people to move and buy property, but there was always the underlying current of activity on which to build the base and subsequent performance.

There is now a wide body of evidence building that this year is set to get even hotter, so we’re going to take a look at a few of those indictors.

Mortgage lending

According to The Guardian, UK mortgage lending has hit record highs recently, indicating that home buying has absolutely exploded in the first quarter of the year.

As reported, ‘The completion of deals took net mortgage lending to £11.3bn in March – higher than in any month since the series began in 1993. With lockdown measures affecting bars, restaurants, shops and other leisure activities, consumers continued to repay credit card debts, with the Bank reporting net repayments of £500m in March.’

These are fairly staggering figures considering we’re emerging from a pandemic induced recession, and with the economy predicted to grow quicker than at any other time in the last 70 years, things could get even better.

Boiling market

The BBC, too, has reported on the housing market being ‘on the boil’, as prices continue to rise and demand hits a high point.

The report stated that, ‘UK house prices rose by 7.1% compared with a year ago, but prices could continue to rise as homes available did not match demand.’

This has led many commentators, economists, and property investors to ask just how far this housing boom could go over the next 12 months?

The answer is that we don’t really know, but with the evidence available, it would seem that even when the stamp duty holiday ends, that demand will continue to far outstrip supply, which in turn is likely to see this trend continue well into and beyond 2021.

For investors already very pleased with growing yields and rents, they can now add big capitals gains to their list of reasons to continue investing in UK property over the next 12 months and beyond.